Offshore Trustee Solutions: Your Strategic Companion in Global Property Management

Wiki Article

Unlock the Conveniences: Offshore Trust Services Explained by an Offshore Trustee

Offshore trust fund services have come to be significantly preferred among individuals and businesses seeking to enhance their economic methods. In this insightful guide, we look into the globe of offshore counts on, offering a detailed understanding of their advantages and how they can be properly made use of. Created by an offshore trustee with years of experience in the area, this source offers beneficial understandings and expert suggestions. From the essentials of offshore counts on to the ins and outs of tax preparation and asset protection, this overview discovers the different benefits they use, including enhanced privacy and privacy, adaptability and control in riches administration, and access to international investment chances. Whether you are an experienced investor or brand-new to the idea of overseas depends on, this guide will certainly furnish you with the expertise essential to open the benefits of these effective monetary tools.The Essentials of Offshore Trust Funds

The essentials of overseas counts on include the establishment and administration of a count on a jurisdiction outside of one's home nation. Offshore depends on are often used for asset security, estate preparation, and tax obligation optimization purposes. By positioning assets in a count on situated in a foreign territory, individuals can guarantee their properties are shielded from prospective threats and responsibilities in their home country.Establishing an offshore trust fund typically needs involving the services of a specialist trustee or trust business that is skilled in the legislations and guidelines of the chosen jurisdiction. The trustee functions as the lawful proprietor of the assets kept in the trust while managing them according to the terms laid out in the trust deed. offshore trustee. This arrangement provides an added layer of security for the possessions, as they are held by an independent 3rd party

Offshore depends on offer a number of benefits. Firstly, they can offer enhanced personal privacy, as the information of the trust fund and its beneficiaries are normally not publicly divulged. They supply prospective tax obligation benefits, as particular territories might have more desirable tax obligation regimens or provide tax obligation exceptions on certain kinds of income or properties held in trust. Overseas counts on can facilitate effective estate planning, permitting people to pass on their wealth to future generations while minimizing inheritance tax obligation liabilities.

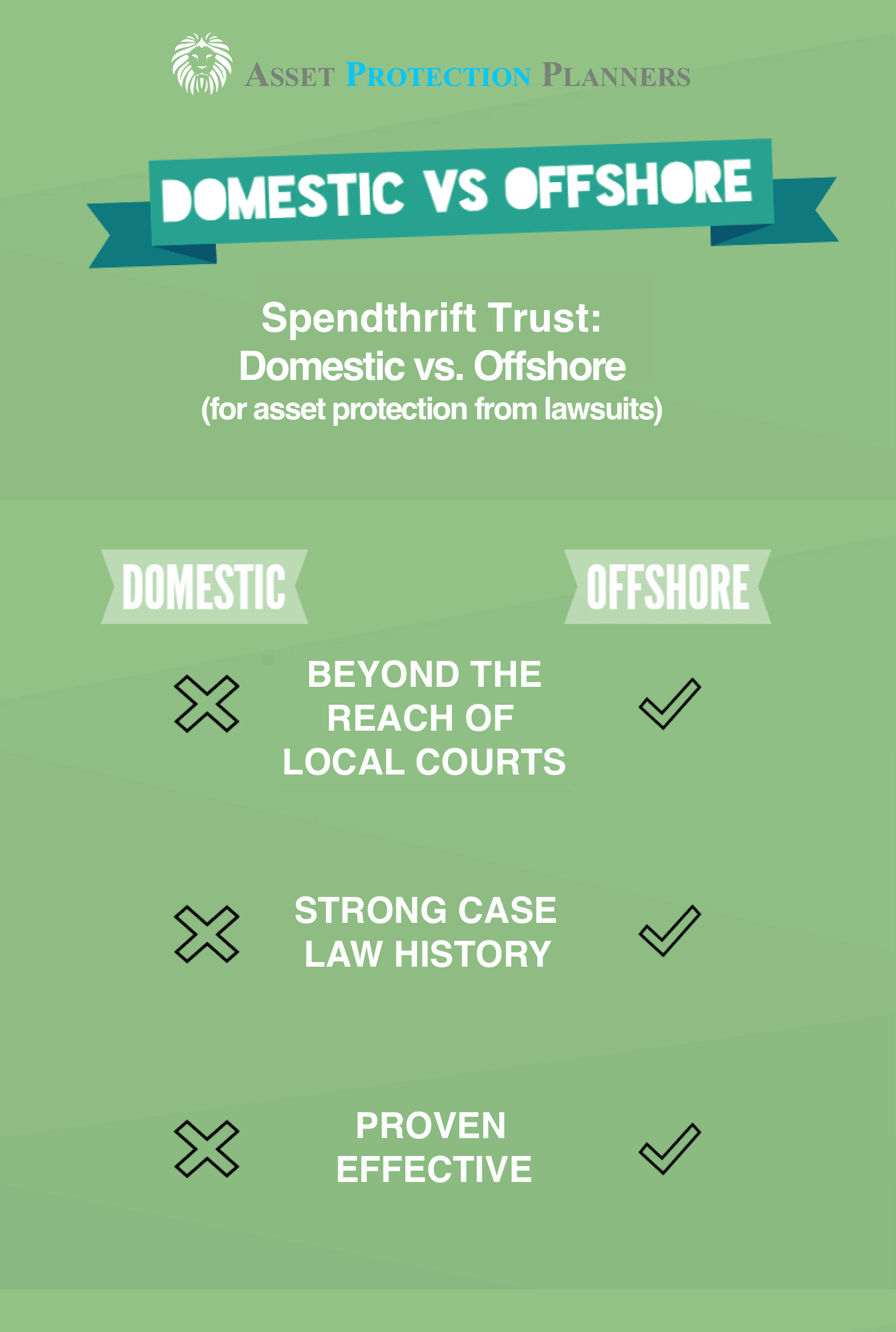

Tax Planning and Possession Security

Tax obligation planning and possession defense play a crucial function in the strategic utilization of offshore trusts. Offshore counts on supply people and businesses with the possibility to decrease their tax responsibilities lawfully while guarding their assets. One of the main advantages of using overseas depends on for tax obligation planning is the capacity to make the most of desirable tax routines in international jurisdictions. These territories commonly supply lower or no tax obligation prices on particular kinds of income, such as resources gains or rewards. By establishing an offshore rely on one of these jurisdictions, companies and individuals can substantially decrease their tax obligation worry.By moving properties right into an offshore count on, individuals can secure their wealth from prospective lawful claims and ensure its conservation for future generations. In addition, overseas trust funds can use confidentiality and personal privacy, additional shielding possessions from prying eyes.

Nevertheless, it is very important to keep in mind that tax obligation planning and asset defense must always be performed within the bounds of the regulation. Involving in illegal tax obligation evasion or deceptive possession protection strategies can result in severe repercussions, consisting of fines, charges, and damage to one's credibility. It is essential to seek expert suggestions from seasoned offshore trustees that can guide people and businesses in structuring their offshore depends on in a compliant and ethical way.

Enhanced Privacy and Confidentiality

When utilizing offshore trust fund services,Enhancing privacy and confidentiality is a paramount purpose. Offshore trust funds are renowned for the high level of privacy and confidentiality they provide, making them an attractive option for people and businesses seeking to safeguard their assets and financial information. Among the essential advantages of overseas depend on solutions is that they offer a lawful framework that permits individuals to maintain their financial events private and shielded from spying eyes.

The boosted personal privacy and confidentiality given by overseas depends on can be specifically helpful for people that value their privacy, such as high-net-worth people, celebrities, and professionals looking for to protect their properties from prospective suits, creditors, or even family members conflicts. By utilizing offshore count on services, individuals can maintain a greater level of personal privacy and discretion, enabling them to safeguard their wealth and monetary passions.

Nevertheless, it is important to note that while overseas trust funds provide boosted privacy and confidentiality, they must still abide by relevant laws and policies, including anti-money laundering and tax reporting needs - offshore trustee. It is great post to read critical to work with trusted and skilled offshore trustees and lawful specialists that can guarantee that all legal commitments are satisfied while making best use of the personal privacy and confidentiality advantages of overseas count on services

Versatility and Control in Wide Range Management

Offshore counts on supply a significant degree of flexibility and control in wealth administration, enabling companies and individuals to properly manage their properties while keeping privacy and confidentiality. Among the essential advantages of offshore depends on is the ability to tailor the depend on structure to meet certain needs and objectives. Unlike traditional onshore depends on, offshore depends on offer a vast array of alternatives for asset protection, tax obligation planning, and sequence preparation.With an offshore trust fund, individuals and services can have greater control over their wide range and exactly how it is taken care of. They can pick the territory where the trust is established, permitting them to benefit from desirable laws and guidelines. This adaptability enables them to optimize their tax obligation position and protect their possessions from prospective threats and obligations.

Additionally, offshore depends on use the option to designate specialist trustees that have considerable experience in handling intricate trusts and navigating global policies. This not just makes sure effective riches monitoring however additionally offers an added layer of oversight and protection.

In enhancement to the flexibility and control supplied by overseas trusts, they also supply confidentiality. By holding properties in an offshore jurisdiction, organizations and individuals can shield their monetary details from spying eyes. This can be specifically useful for high-net-worth people and companies that worth their privacy.

International Investment Opportunities

International diversification provides individuals and businesses with a multitude of financial investment opportunities to increase their profiles and alleviate risks. Buying international markets permits financiers to access a wider variety of possession courses, industries, and geographical regions that may not be readily available locally. By diversifying their financial investments across different nations, investors can minimize their direct exposure to any type of solitary market or economic climate, hence spreading their risks.One of the essential advantages of international investment possibilities is the capacity for greater returns. Different countries might experience varying financial cycles, and by purchasing multiple markets, financiers can maximize these cycles and possibly achieve higher returns compared to spending exclusively in their home country. Additionally, investing worldwide can also give accessibility to emerging markets that have the potential for quick economic growth and higher financial investment returns.

Furthermore, global investment chances can provide a hedge against money risk. When investing in international money, financiers have the possible to benefit from money variations. As an example, if a capitalist's home currency weakens against the money of the foreign investment, the returns on the financial investment can be enhanced when transformed back to the investor's home currency.

Nevertheless, it is necessary to note that investing internationally additionally includes its very own collection of threats. Political instability, regulatory changes, and geopolitical uncertainties can all affect the i was reading this performance of international investments. For that reason, it is critical for capitalists to carry out extensive study and seek expert recommendations before venturing into worldwide financial investment chances.

Verdict

The fundamentals of overseas counts on include the facility and administration of a count on in a jurisdiction outside of one's home country.Developing an overseas trust fund commonly needs engaging the solutions of an expert trustee or trust fund firm who is fluent in the regulations and laws of the picked jurisdiction (offshore trustee). The trustee acts as the legal owner of the assets held in the trust while handling them in accordance with the terms set out in the trust fund act. One of the vital benefits read this post here of offshore trust funds is the ability to customize the depend on framework to satisfy particular needs and objectives. Unlike typical onshore counts on, offshore depends on supply a vast range of alternatives for asset security, tax planning, and succession planning

Report this wiki page